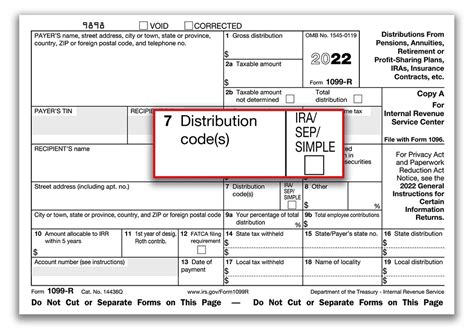

box 9a - your percentage of total distribution Box 9a. Your Percentage of Total Distribution. If this is a total distribution and it is made to more than one person, enter the percentage received by the person whose name appears on Form . These are the CNC routers that fall in the lowest price range and that is best suited for small businesses and hobbyists who do projects in their spare time. These CNC router machines are excellent for learning the ropes and they can definitely bring returns if properly used and thoroughly mastered.

0 · taxable amount not determined

1 · ira sep simple 1099 r

2 · gross distribution on 1099 r

3 · form 1099 r distribution codes

4 · 1099 r taxable amount

5 · 1099 r boxes explained

6 · 1099 r box 9a

7 · 1099 r box 16 blank

$29.90

Box 9a, percent of total distribution, is generally used when a 1099-R distribution is split between more than one person. This is unusual, and if it was empty on the form you received you can leave it blank in TurboTax.The entry in box 9(a) is supposed to show your percentage of the distribution .

Box 9a. Your Percentage of Total Distribution. If this is a total distribution and it is made to more than one person, enter the percentage received by the person whose name appears on Form . Box 9a, percent of total distribution, is generally used when a 1099-R distribution is split between more than one person. This is unusual, and if it was empty on the form you .

Box 9a - Your percentage of total distribution shows the percentage of a total distribution received by the taxpayer when the distribution was made to more than one person. Box 9b - Total employee contributions shows the . The entry in box 9(a) is supposed to show your percentage of the distribution entered in box 1. If you did not share the distribution with anyone, you should leave the entry . Box 9a: Your percentage of total distribution. If this is a total distribution and it is made to more than one person, Box 9a should contain the amount that you received. However, the custodian may not complete Box 9a .Box 9a: Percent (%) of Total Distribution The percentage you received of a distribution to multiple beneficiaries of a member. Box 9b: Total Employee Contributions only completed for the .

Service retirement or pre-retirement death monthly benefit distribution being paid to a participant who is at least 59 1/2 on December 31 of the tax year being reported. This indicates what percentage of the entire benefit you .

Box 9a: Your percentage of total distribution If the recipient received a portion of a distribution sent to multiple people—for instance, if the owner of the plan died and had multiple beneficiaries or .

Box 9a: If you received part of a distribution that was sent to more than one person, you’ll see the percentage of the total distribution that you received here. Box 9b: This will show your total investment in a life annuity. Box 9a, percent of total distribution, is generally used when a 1099-R distribution is split between more than one person. This is unusual, and if it was empty on the form you received you can leave it blank in TurboTax.Box 9a. Your Percentage of Total Distribution. If this is a total distribution and it is made to more than one person, enter the percentage received by the person whose name appears on Form 1099-R. You need not complete this box for any IRA distributions or for a direct rollover. Box 9a, percent of total distribution, is generally used when a 1099-R distribution is split between more than one person. This is unusual, and if it was empty on the form you received you can leave it blank in TurboTax.

Box 9a - Your percentage of total distribution shows the percentage of a total distribution received by the taxpayer when the distribution was made to more than one person. Box 9b - Total employee contributions shows the taxpayer’s total investment in a life annuity from a qualified plan. The entry in box 9(a) is supposed to show your percentage of the distribution entered in box 1. If you did not share the distribution with anyone, you should leave the entry blank. Otherwise, you would enter the percentage of the distribution that you received. Box 9a: Your percentage of total distribution. If this is a total distribution and it is made to more than one person, Box 9a should contain the amount that you received. However, the custodian may not complete Box 9a for any IRA distributions or for a direct rollover. Box 9b: Total employee contributionsBox 9a: Percent (%) of Total Distribution The percentage you received of a distribution to multiple beneficiaries of a member. Box 9b: Total Employee Contributions only completed for the calendar year in which you retire. Amount shown is the total of your unsheltered contributions into the plan.

Service retirement or pre-retirement death monthly benefit distribution being paid to a participant who is at least 59 1/2 on December 31 of the tax year being reported. This indicates what percentage of the entire benefit you received when a death benefit lump sum distribution is paid to more than one beneficiary.Box 9a: Your percentage of total distribution If the recipient received a portion of a distribution sent to multiple people—for instance, if the owner of the plan died and had multiple beneficiaries or if retirement distributions are split after a divorce—the percentage of that amount is noted here.Box 9a: If you received part of a distribution that was sent to more than one person, you’ll see the percentage of the total distribution that you received here. Box 9b: This will show your total investment in a life annuity.

Box 9a, percent of total distribution, is generally used when a 1099-R distribution is split between more than one person. This is unusual, and if it was empty on the form you received you can leave it blank in TurboTax.Box 9a. Your Percentage of Total Distribution. If this is a total distribution and it is made to more than one person, enter the percentage received by the person whose name appears on Form 1099-R. You need not complete this box for any IRA distributions or for a direct rollover. Box 9a, percent of total distribution, is generally used when a 1099-R distribution is split between more than one person. This is unusual, and if it was empty on the form you received you can leave it blank in TurboTax.

Box 9a - Your percentage of total distribution shows the percentage of a total distribution received by the taxpayer when the distribution was made to more than one person. Box 9b - Total employee contributions shows the taxpayer’s total investment in a life annuity from a qualified plan. The entry in box 9(a) is supposed to show your percentage of the distribution entered in box 1. If you did not share the distribution with anyone, you should leave the entry blank. Otherwise, you would enter the percentage of the distribution that you received.

taxable amount not determined

ira sep simple 1099 r

Box 9a: Your percentage of total distribution. If this is a total distribution and it is made to more than one person, Box 9a should contain the amount that you received. However, the custodian may not complete Box 9a for any IRA distributions or for a direct rollover. Box 9b: Total employee contributions

Box 9a: Percent (%) of Total Distribution The percentage you received of a distribution to multiple beneficiaries of a member. Box 9b: Total Employee Contributions only completed for the calendar year in which you retire. Amount shown is the total of your unsheltered contributions into the plan.Service retirement or pre-retirement death monthly benefit distribution being paid to a participant who is at least 59 1/2 on December 31 of the tax year being reported. This indicates what percentage of the entire benefit you received when a death benefit lump sum distribution is paid to more than one beneficiary.

gross distribution on 1099 r

Box 9a: Your percentage of total distribution If the recipient received a portion of a distribution sent to multiple people—for instance, if the owner of the plan died and had multiple beneficiaries or if retirement distributions are split after a divorce—the percentage of that amount is noted here.

form 1099 r distribution codes

1099 r taxable amount

Check out our wooden box with hinged lid lock selection for the very best in unique or custom, handmade pieces from our boxes & bins shops.Yes, saloon doors can absolutely be used for outdoor areas. These swinging doors are durable and weather-resistant, designed specifically for exterior use. You can find saloon doors in materials like aluminum, steel, and .

box 9a - your percentage of total distribution|ira sep simple 1099 r