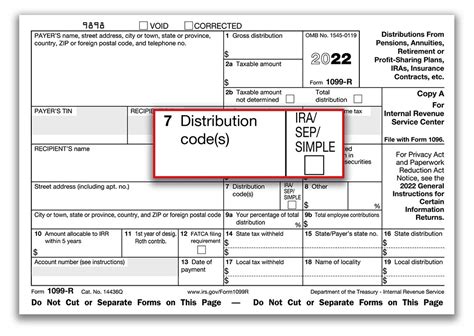

distribution code 1 and 3 in box 7 of 1099-rcode One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply . Meet your new DIY addiction! This article will show you how to make original welded furniture projects for your home, without having to break the bank. Whether you’re just starting out welding or have been practicing for years, there are projects here for everyone.

0 · what does code 7d mean

1 · irs 1099 box 7 codes

2 · form 1099 box 7 codes

3 · distribution code 7 normal

4 · 1099r box 7 code 8

5 · 1099 r distribution code m2

6 · 1099 r distribution code e

7 · 1099 distribution code 7d

Find Champ Pans Weld-On Battery Boxes and get Free Shipping on Orders Over $109 at Summit Racing! Champ Pans weld-on battery boxes are made from steel and are lightweight, yet strong. They're available with or without mounting ears. Secure your battery with a stylish foundation; order the weld-on battery box best suited for your engine bay.The Sandusky classic series welded steel combination cabinet features a sectioned interior to help you organize your office, business, garage, basement, or workshop.

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply .For a distribution of contributions plus earnings from an IRA before the due date of the return under section 408(d)(4), report the gross distribution in box 1, only the earnings in box 2a, and .

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early .

Code 1 is used if the distribution is made for medical expenses, health insurance premiums, qualified higher education expenses, a first-time home purchase, a qualified .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, . *Non-qualified Roth Distribution (less than 5 years) – use code B and complete Box 11 (Roth clock start), the principal Roth contribution amount in Box 10, and the taxable amount .

Today’s post can be used as a reference when deciphering the code (s) found in Box 7, which is the distribution code (s) box of your Form 1099-R. Who completes Form 1099-R? First of all, it’s good to know that the institution who made .

Box 7 on Form 1099-R contains distribution codes that help taxpayers and the IRS understand the nature of the distribution. These codes are essential for accurately reporting the distribution on the taxpayer's tax return .Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. 1 – Early distribution (except Roth), no . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.

For a distribution of contributions plus earnings from an IRA before the due date of the return under section 408(d)(4), report the gross distribution in box 1, only the earnings in box 2a, and enter Code 8 or P, whichever is applicable, in box 7.Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329; Code 1 is used if the distribution is made for medical expenses, health insurance premiums, qualified higher education expenses, a first-time home purchase, a qualified reservist distribution. A governmental section 457 (b) plan distribution that is .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

*Non-qualified Roth Distribution (less than 5 years) – use code B and complete Box 11 (Roth clock start), the principal Roth contribution amount in Box 10, and the taxable amount in Box 2A. Code 3: Disability. None: Code 4: Death. 8 (Excess Contributions, Excess Deferrals, and Excess Aggregate Contributions taxable in year of distribution)

what does code 7d mean

irs 1099 box 7 codes

Today’s post can be used as a reference when deciphering the code (s) found in Box 7, which is the distribution code (s) box of your Form 1099-R. Who completes Form 1099-R? First of all, it’s good to know that the institution who made distributions–and not the individual receiving distributions–will complete the Form 1099-R.

Box 7 on Form 1099-R contains distribution codes that help taxpayers and the IRS understand the nature of the distribution. These codes are essential for accurately reporting the distribution on the taxpayer's tax return and determining the appropriate tax treatment.

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. 1 – Early distribution (except Roth), no .

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.For a distribution of contributions plus earnings from an IRA before the due date of the return under section 408(d)(4), report the gross distribution in box 1, only the earnings in box 2a, and enter Code 8 or P, whichever is applicable, in box 7.Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329; Code 1 is used if the distribution is made for medical expenses, health insurance premiums, qualified higher education expenses, a first-time home purchase, a qualified reservist distribution. A governmental section 457 (b) plan distribution that is .

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½). *Non-qualified Roth Distribution (less than 5 years) – use code B and complete Box 11 (Roth clock start), the principal Roth contribution amount in Box 10, and the taxable amount in Box 2A. Code 3: Disability. None: Code 4: Death. 8 (Excess Contributions, Excess Deferrals, and Excess Aggregate Contributions taxable in year of distribution)

Today’s post can be used as a reference when deciphering the code (s) found in Box 7, which is the distribution code (s) box of your Form 1099-R. Who completes Form 1099-R? First of all, it’s good to know that the institution who made distributions–and not the individual receiving distributions–will complete the Form 1099-R.

form 1099 box 7 codes

distribution code 7 normal

MIG is the ideal method for welding a 20-gauge metal sheet. The process is fast and simple to use. The only downside is you cannot use it for outside welding as the wind can easily blow out your shielding gas.

distribution code 1 and 3 in box 7 of 1099-rcode|1099 r distribution code m2